BACKGROUND

Ninety-three percent of India’s US$670 billion retail market continues to be unorganized, operating through mom-and-pop, kirana or standalone stores.1 According to a recent Boston Consulting GroupConfederation of Indian Industry (BCG-CII) report, this sector is projected to double from a US$1.1-1.2 trillion market by 2020, driven by a 70 percent rise in income levels and a 100 million addition in the number of youth entering the labor force.2 However, despite growth projections, there are several factors that hinder the growth of these informal enterprises which provide livelihood options to nearly 111 million workers,3 thus forming an important engine for India’s economic growth.

The lack of proper infrastructure and technical skills notwithstanding, a pressing factor hindering attainment of scale by informal enterprises is the lack of credit from formal sources at affordable rates of interest. According to an International Finance Corporation (IFC) report, the credit gap for informal enterprises within the Micro, Small and Medium Enterprises (MSME) sector in India was estimated at US$418 billion in 2012-13.4 Underlying the gap in accessing formal credit is the story of missing applicant credit histories or other parameters of credit worthiness used in traditional appraisal processes by lenders.5 Under such circumstances, most enterprises resort to informal lenders, despite the high interest rates charged. Reluctance to adopt digital payments further exacerbates this situation, since it is near impossible to convince lenders of credit worthiness in the face of missing information on credit and other transactional histories. Lack of awareness, low capability and unwillingness to try new technologies for fear of failure are some reasons that contribute to this wariness and create a vicious cycle that has been hard to break.

CATALYST, in its drive to explore the digital readiness of this segment, hypothesized that providing access to a small amount of credit at lower rates could act as a hook for digital payment adoption and usage, which in turn could trigger a positive spiral to access higher amounts of credit. In a preliminary study to understand the financial behavior and borrowing pattern of small businesses, CATALYST conducted a Credit Needs Assessment Survey (CNAS) where 1,140 small fixed store merchants in Jaipur were interviewed in September 2017. The survey showed that 69 percent of the merchants sourced their credit from informal sources such as friends, family and local moneylenders. Merchants expressed dissatisfaction with local moneylenders because they charged an interest rate of over 30 percent per month. But they still tend to prefer informal lenders over formal ones because of ease of access, no requirement of lengthy documentation, and speedy processes.

Armed with these insights, CATALYST launched the Credit as a Hook pilot in Jaipur in June 2018 for a select set of merchants. The pilot aimed to provide incremental loans through a starter-builder model starting with a small loan that would increase based on usage of digital payments, where the payment footprint would help merchants build their formal credit history. CATALYST hypothesized that, for the merchants, this would result in larger loans over a period of time at better rates of interest. For lenders, the presence of a digital footprint would provide the means to underwrite loans better and allow them to acquire new customers (i.e., a set of small merchants that was hitherto unserved by formal financial institutions). The initial pre-assessment survey carried out prior to the product launch, CATALYST’s CNAS report, revealed that 92 percent merchants contacted during the survey was aware of digital payment solutions. Of these, 53.5 percent was interested in availing credit through a digital platform with an expectation of quick processing time.

The first challenge that CATALYST faced was to convince lenders to provide an initial loan, albeit small, in the absence of a digital payment history. Traditionally, the route to access credit has been via an established digital payment footprint because of the inherent difference in the way payment and credit operates. Payment systems work better when more people use them, and therefore are designed to be more inclusive in nature. Credit, on the other hand, is designed to hedge excessive risks, and therefore is harder to establish as the first step to financial inclusion of the underserved market segment with no credit history.

A lending model is predicated on profits from taking calculated risks. So, lenders seek to build strong relationships with their customers and get a broad base of information to calculate the exact underlying risk. On the other hand, payment companies are inherently less dependent on understanding customer risk. Payment businesses therefore tend to be more transactional and less relationship-based than lending ones. The quality or depth of individual customer relationships matters less. Instead, the number and breadth of customers and their networks matter more.6

Understanding these basic functions of payments and credit is critical to exploring how the two can be linked. Technology and access to customer data play a huge role in leveraging the payment and credit lens to achieve financial inclusion.

The CATALYST pilot aimed at precisely this understanding. How can we urge merchants to start using digital solutions, which in turn can help them access credit at better terms?

While the merits of credit are known, research is beginning to show the advantages of digital credit as well. Early evidence from studying M-Shawri7 in Kenya has shown that uptake of digital loans has helped improve household resilience against shocks and increased the propensity of families to spend on welfare activities such as health and education.8 While we have little evidence available from similar experiments in India, we expect the positive benefits would be similar.

We hope that the following results of CATALYST’s Credit as a Hook pilot reveal the opportunities and challenges of launching a digital payment and loan product bundle for underserved informal sector merchants in India.

- India’s $670 billion retail market is heading for a dream run, April 16, 2018, Quartz.

- Retail Transformation: Changing Your Performance Trajectory, BCG-CII National Retail Summit Report, 2016.

- Found: 111 million MSME workers in India as data rules changes, Livemint, November 22, 2017.

- MSME Finance Gap, Assessment of the shortfalls and opportunities in financing micro, small and medium enterprises in emerging markets, IFC, 2017.

- Research by Entrepreneurial Finance Lab, retrieved from The Hindu Business Line, ‘There is a credit gap of 56% in the MSME sector’, July 2, 2014

- Buckley, R. and I.Mas. The coming of age of digital payment as a field of expertise, Journal of Law Technology and Policy, June 2016, Vol.2016.

- M-Shwari is a paperless banking service offered through M-Pesa. M-Shwari bank accounts are opened and maintained through mobile phones.

- Bharadwaj, P., W. Jack and T. Suri. Can Digital Loans Deliver: Take Up and Impact of Digital Loans in Kenya, 2018 (Working Paper, draft received on special request from T. Suri).

INSIGHTS FROM THE PILOT

Testing the hypothesis involved bringing together a payment provider and a lender — a role that was played by CATALYST. For the pilot, CATALYST partnered with Nupay, a Point of Sale (PoS) device or card swipe machine provider and an early stage startup, and Capital First, a Non Banking Financial Company (NBFC), which agreed to provide term loans to fixed store merchants in Jaipur. The combination of a payment device and loan was offered as a bundle, with the intention of testing the extent to which credit can act as a ‘hook’ to adopt and use digital payments. This combination was created for the purpose of the pilot alone since lenders are unclear of the risks involved in offering a small amount of credit, no matter how small, before they can establish credit history based on transactions on the device provided. Since the combination of partners was arranged by CATALYST for the pilot, CATALYST also had to provide a set of Feet on Street (FoS) for on-the-ground support to roll out the services. The FoS team, trained by CATALYST, provided support in marketing and customer acquisition.

Product bundle: Capital First and Nupay, a term loan with a card swipe machine

Product bundle details: Capital First (the lender) agreed to provide loans of a ticket size of INR 25,000 to INR 5 lakh at an interest rate of 18 percent to 24 percent annually for a tenure of nine months to 36 months, depending on the ticket size and repayment capacity.

Nupay’s card swipe machine had a monthly rental of INR 350 (~ US$5) plus 18 percent Goods and Service Tax (GST), which was also to be paid by merchants. The lender agreed that merchants would be considered for an incremental loan based on their repayment history observed in the first tranche of the loan, and their digital transaction footprint.

Project roll-out and findings: digital payment adoption vs. non-adoption

During the pilot, CATALYST reached out to 409 fixed store merchants across six major markets in Jaipur (Shastri Nagar, Sodala, Durgapura, Khatirpura, Jhotwara and Bani Park).9 These stores have been in business for an average of 10 years and had a median monthly revenue of INR 45,000. Most stores (99 percent) were owned by men; 87 percent was sole proprietorships while a smaller group (13 percent) was managed jointly with other family members. Sixty-five of them were already using a PoS or a card swipe machine and the remaining 344 merchants were given a demo on using a new PoS machine with the help of CATALYST’s FoS team.

This data set is separate from the earlier CNAS data. With a time lag of eight months, it is often difficult to work with earlier data sets. So, 490 new fixed stores were chosen from six new markets in Jaipur

Key results from the experiment were:

- There were eight fixed store merchants who had never used a card swipe machine but eventually adopted digital payment solutions after being trained on card swipe usage by the CATALYST FoS team.

- The primary reason for adoption was that it would allow them to service a broader customer segment that used (debit/credit) cards to make payments. In other words, the ability to serve a specific customer segment that was familiar with digital solutions was a key driver. This would also result in new customer acquisition over a period of time.

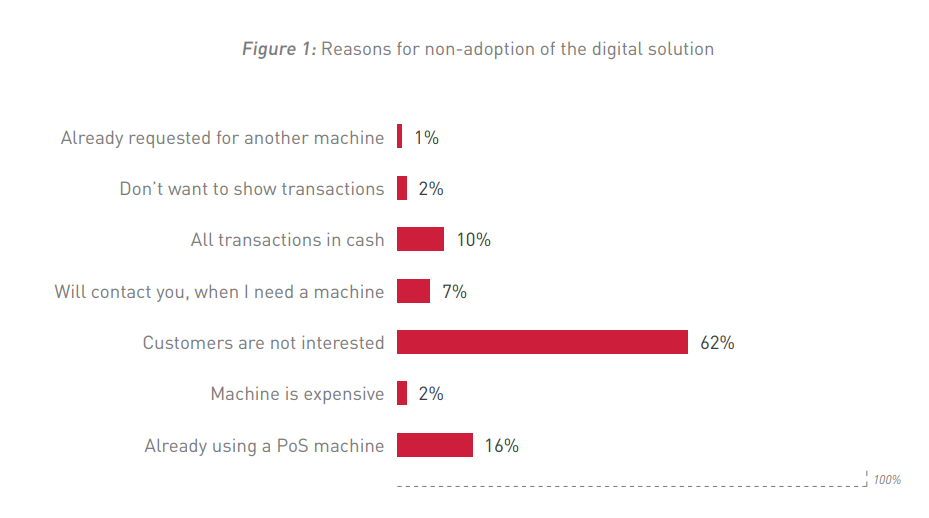

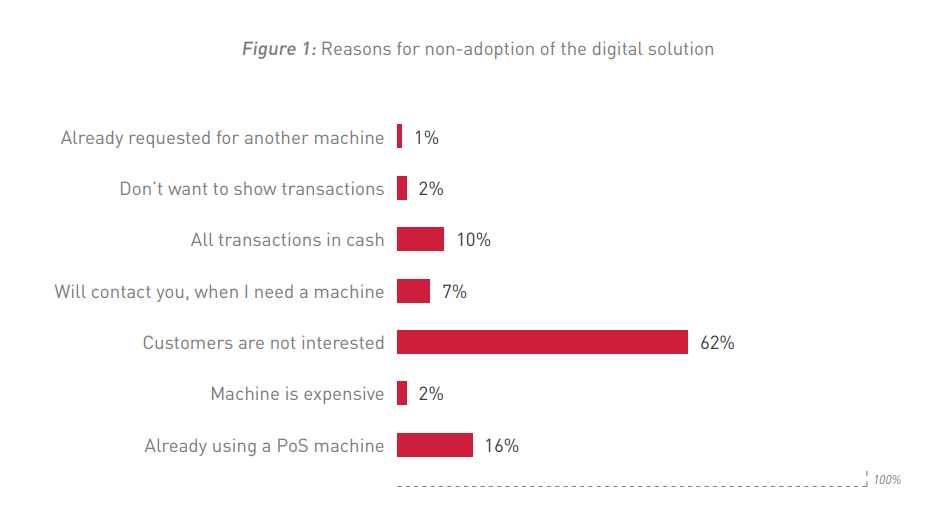

- Among the merchants who refused to use or adopt a PoS machine, the dominant reason for nonadoption was the absence of customer demand (62 percent, Figure 1). These merchants were unwilling to act as enablers to train customers in using a new digital solution. If the customers asked for the service, they were happy to provide it.

- The remaining 10 percent (Figure 1) reported the inherent cash stickiness of their business as a major deterrent. Another 2 percent (Figure 1) cited the cost of the machine as a major barrier to accepting digital payments.

Note: From top right: existing loan usage, source of loan, purpose of loans and awareness about CIBIL scores of 18 merchants who agreed to reveal information about a prior loan.

While most merchants who were part of the pilot preferred not to share their current loan practices, those who revealed that they had availed a loan (18 out of 409) had done so from a formal source. Fourteen of the 18 were also aware of their credit score (CIBIL) and its related impact on their credit eligibility.

- Only 18 fixed store merchants (4 percent) with an average monthly revenue of INR 90,000 (double the population median of INR 45,000) reported that they had availed of a loan in the past.

- The average tenure of the loans was two to three years; 17 merchants sourced the loan from banks and one from a Micro Finance Institution (MFI);

- The purpose for which loans were taken varied from business expansion (10 merchants), household requirements (four merchants) to health emergencies (one merchant). Utility loans such as for two wheelers (three merchants) formed another major category of reasons for taking loans; and

- The ticket size of the loans taken by the merchants varied from INR 40,000 to INR 9 lakhs.

MERCHANTS’ PERCEPTION ON THE BUNDLED PRODUCT

Perceived vs. real interest in loan: When offered the bundled product of payment device and credit, 25 merchants showed initial interest solely in accessing the loan during their first interaction with the CATALYST FoS team. However, 24 had changed their minds when the lender’s agent approached them after a week, perhaps because merchants are always interested in understanding options for credit but may not avail of it even if they express an interest initially.

One merchant who agreed to try the combination of a PoS device and loan had a fixed cloth store in Shastri Nagar market. He wanted a loan of INR 1-2 lakhs. Unfortunately, the request was denied since his residence was located outside the serviceable area set by the lender. This fact was discovered after the processing was done, and resulted in a poor customer experience for the merchant.

Why was there a low uptake?

The experiment shows that while there was individual adoption of the card swipe machines, there was little uptake of the bundled product. Technology did seamlessly bind the products together but the communication to merchants was often unclear and did not explain how payment device usage would help them get a loan of higher amount in the future. The reasons this product could not cater to customer expectations or improve customer experience as expected are:

Loan structure: While the lender assured the merchants of a credit-build-up model, the merchants were keen to understand the exact qualifiers for the build-up process, i.e., number and/or value of transactions required to qualify for the next tranche of loans. Additionally, they wanted to know by what percentage the loan amount could grow through increased usage of digital transactions. None of this information was provided to merchants since the lender had not yet thought it through. The product’s value proposition stated in one line by the lender as ‘enhanced loan size for incremental usage of digital payments’ failed to gain the merchants’ trust.

Single interface for credit and digital payments: During the CATALYST pilot, the lending company and the digital payment solution company used two separate applications to onboard customers. For the merchants who saw the two as a single product, it was important for the digital payment solution provider and the lending partner to integrate their solution into one single application for simplicity and usage. The existing process offered poor customer experience because filling out two applications is a time-consuming process.

Large time lags: Loan disbursal followed a lengthy process, i.e., lead generation by field agents (CATALYST FoS team) from an initial interaction, followed by a calling exercise by the credit assessor and then a site verification. This long time period between initial contact and disbursement was a pain point. Additionally, there were delays in disbursing the card swipe machine. Partnering with an early stage startup for PoS machines led to a resource crunch, which resulted in operational delays. The time lag between initial lead generation and delivery of the machine ranged from 15-20 days which was too long a time to retain interest.

High cost of on boarding: The loan offer had a customer onboarding cost plus GST that hiked up the existing rates of interest by 3 to 4 percent so the lending interest rate worked out to be around 30 percent annually. These nuanced details deterred many of the merchants to finally take up the loan despite having shown an initial interest in the loan product.

Short tenure of the pilot: Lastly, one must note that three or four months is too short a time to launch and iterate on a product bundle that includes a loan repayment timeline of nine to 36 months. To understand access and usage of repeat loans, the pilot experiment should essentially be of a much longer tenure.

RECOMMENDATIONS

Need for a local presence: An implementation challenge that needs to be addressed in order to iterate on the pilot experiment and help it succeed is decreasing the time lags between the first point of contact to in-person onboarding with the card swipe machine and the loan. To avoid such operational delays, it is advisable to work with a local company with a greater field presence than with a well-known company based out of another metropolis but with little field support, as was the case during this pilot. Otherwise, the card swipe company/loan company should partner with a channel partner that should be assigned locally to cover the high customer acquisition cost which must be incurred (by default) for wider reach and larger impact among the segment of merchants who are new to digital payment usage.

Lower cost of product: If such loans could get priority sector lending status, obtaining funds would be easier for an NBFC, making access to credit easier and cheaper.

Alternate digital payment solutions: Current credit products are more inclined towards PoS machine uptake and usage. However, given the rise in use of other digital payment modes such as Unified Payments Interface (UPI), e-wallets and other Aadhaar-based solutions could lead to faster and cheaper adoption among merchants.

Simple product structure: As the pilot results suggest, clearly informing the merchants of the exact qualifying factors for incremental loans will help develop higher trust and better customer relationships for a credit-builder model.

Provide digital training and awareness: Multiple field visits and available data on awareness of credit history or usage of digital payments suggest that small fixed store merchants need substantial handholding, training and awareness to understand fundamental financial concepts, the importance of formal loans, and use of credit history. The experiment results suggest that the small merchants would be better off with expert handholding support and training from their first point of contact, as they would be without operational delays. Further, digital training and awareness building must extend to consumers who shop at these merchant locations, since customer demand is a huge driver in merchant acceptance of digital solutions.

CONCLUSION

Credit can potentially act as a hook for usage of digital solutions, provided the effective costs are lower compared to credit from informal sources, and access is speedier. Merchants also need to be provided information on the clear pathway on increase in credit as they continue using the digital facilities. Lenders and payment service providers must present a unified front and offer a superior customer experience to the merchants. Lastly, acceptance of new payment solutions requires end customers to be sensitized equally

TECHNICAL WRITERS: John Arun and Shubhranka Mondal

ACKNOWLEDGEMENTS: The authors would like to thank Jayshree Venkatesan for her expert advice, and CATALYST’s Feet on Street team, for their ground support