Digital payments uptake by small merchants is a stepping stone to broaden financial inclusion. Integrating these small merchants into the digital payment eco-system is an imperative need and critical element to realise the vision of a cash-light economy.

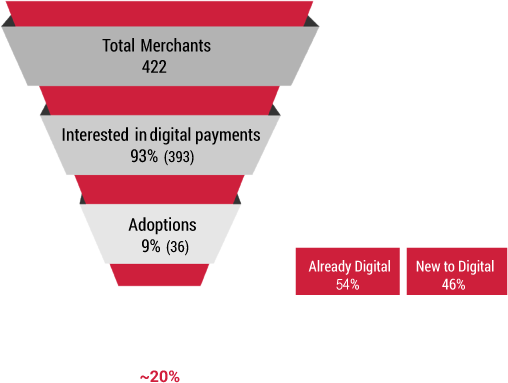

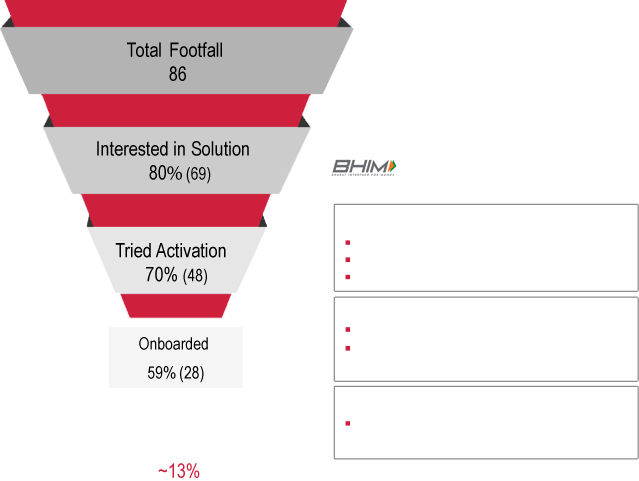

Catalyst has established a Digital Payment Lab in Jaipur to formulate experiments, learn through an iterative process to institutionalize scalable and demonstrable templates for large-scale implementations. Catalyst organised a �Digital Payment Shivir� in one of Jaipur�s bustling market – Barkat Nagar, to handhold merchants into initiating a digital payment value-chain. The open-to-all camp is one of the first experiments of the Digital Payment Lab that endeavored towards educating, facilitating, onboarding small merchants and low-income consumers into the digital payment eco-system

The experiment kick started with a week of feet-on-street activities, shop-to-shop campaign to educate and understand merchant�s solution choice and culminated in a 3 day long camp (Shivir), at the main market area at Barkat Nagar.

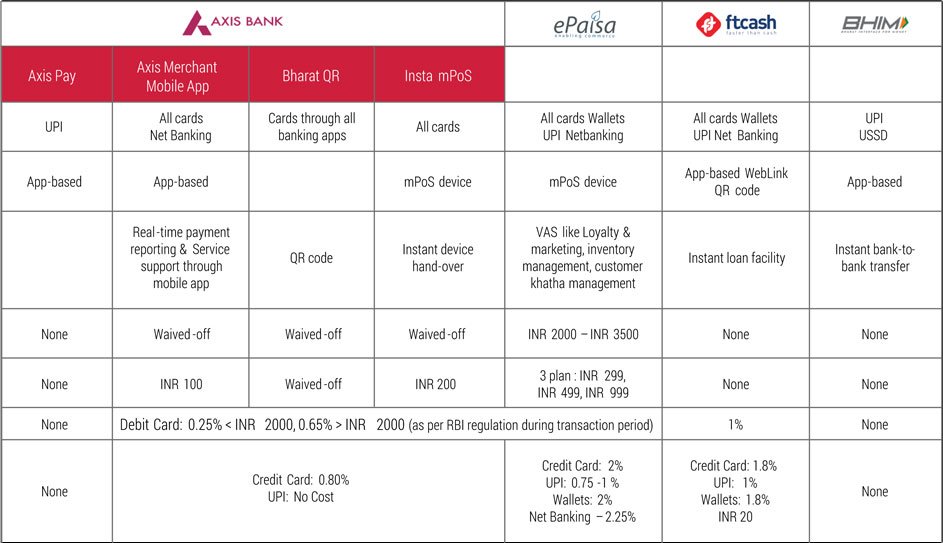

One of the key objectives of the camp was to evaluate the most viable, suitable solution out of the varied options available for the fixed store merchant segments and importantly, to also analyze the intrinsic barriers to adoption. Catalyst�s formal agreement with the Government of Rajasthan and their formidable support significantly helped the efforts of this experiment in building strategic partnerships with Digital payment solution partners & banks such as EPaisa, FTCash and AxisBank.