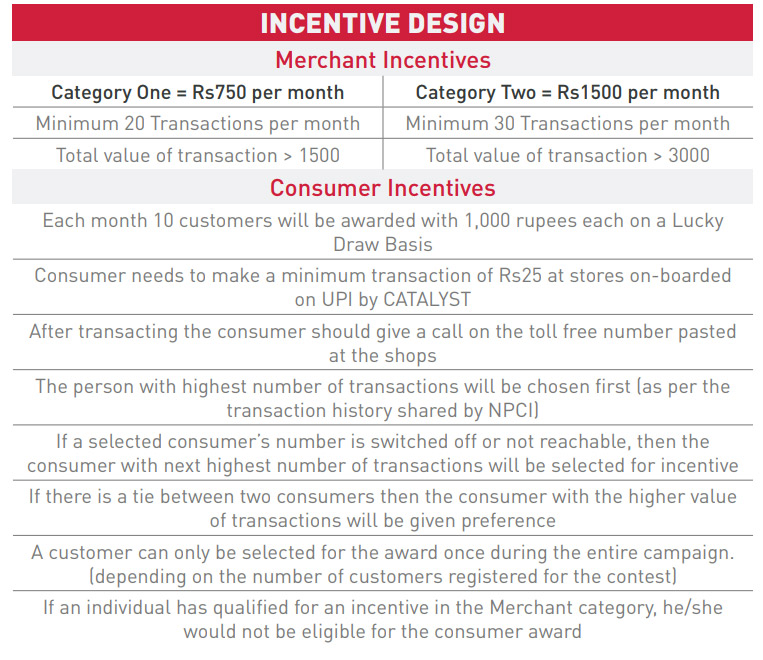

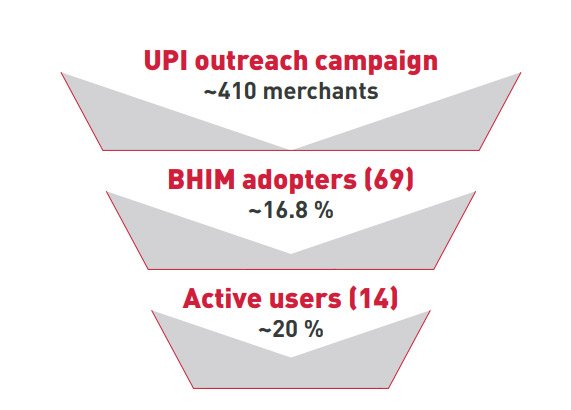

Since its introduction in August 2016, the Unified Payments Interface (UPI) has been a game changer for the digital payments ecosystem in India. The interface allows bank customers to make payments to another bank account on a real-time basis using the Immediate Payment Service (IMPS). The National Payments Corporation of India’s BHIM application, which is based on the UPI interface, was one of the first few UPI applications to gain traction among users. As part of its Digital Payments Lab in Jaipur, Catalyst piloted a merchant-centric UPI awareness and adoption campaign in a market cluster of nearly 400 retail outlets, Barkat Nagar, surrounded by a dense residential locality. The objective of the campaign was to enable merchants to accept payments via UPI-enabled applications at the point of sale, using Quick Response (QR) code stickers. It also endeavoured to test the suitability of the QR-based UPI solution for small merchants, and analyse the role of financial incentives and handholding models as an intervention to boost adoption and use by merchants and customers.

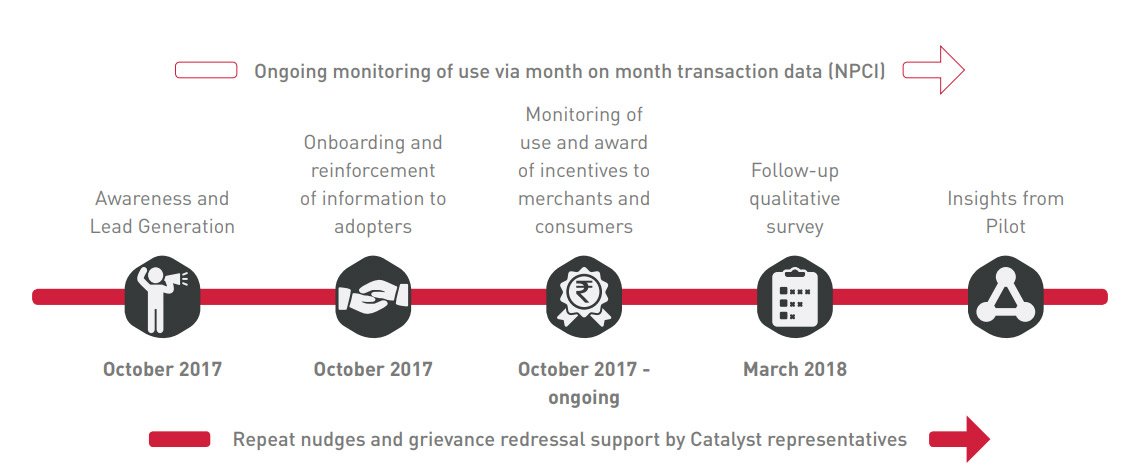

A follow-up survey was conducted four months after the campaign’s launch, to garner feedback from a sample of users as well as non-adopters.

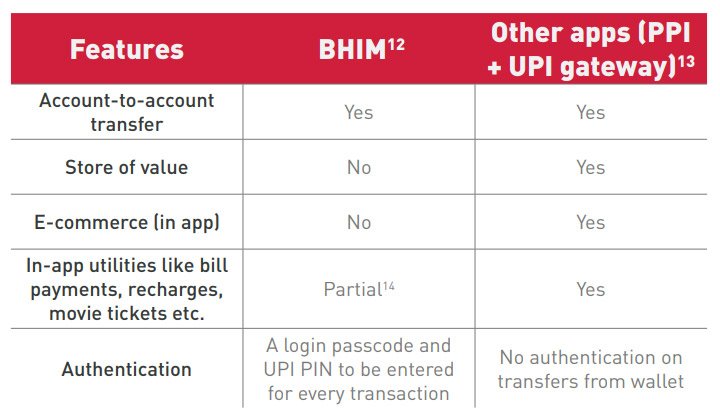

This note discusses learnings and insights from Catalyst’s pilot UPI awareness and activation campaign, followed by insights from the feedback survey that was conducted in March 2018. It provides an analytical perspective on the features that work in favour of BHIM, and barriers to its wider adoption and use. From a use perspective, insights suggest that the BHIM application faces stiff competition from other UPI applications and payment platforms in the market. The authors make a case for reorienting BHIM as an ‘ecosystem enabler’ and propose two strategies to this end.