BACKGROUND

Since its introduction in August 2016, the Unified Payments Interface (UPI) has been a game changer for the digital payments ecosystem in India. The interface allows bank customers to make payments to another bank account on a real-time basis using the Immediate Payment Service (IMPS). The National Payments Corporation of India’s BHIM application, which is based on the UPI interface, was one of the first few UPI applications to gain traction among users. As part of its Digital Payments Lab in Jaipur, Catalyst piloted a merchant-centric UPI awareness and adoption campaign in a market cluster of nearly 400 retail outlets, Barkat Nagar, surrounded by a dense residential locality. The objective of the campaign was to enable merchants to accept payments via UPI-enabled applications at the point of sale, using Quick Response (QR) code stickers. It also endeavoured to test the suitability of the QR-based UPI solution for small merchants, and analyse the role of financial incentives and handholding models as an intervention to boost adoption and use by merchants and customers.

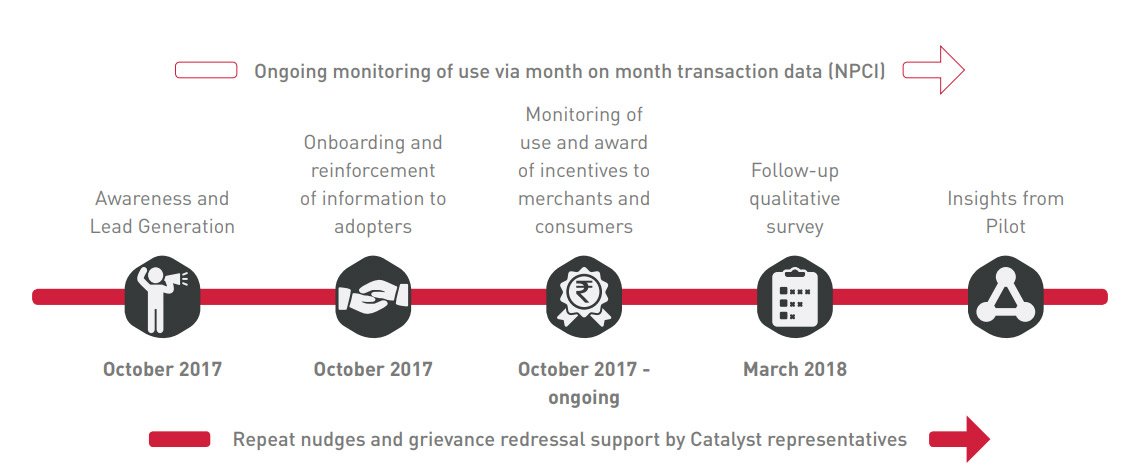

A follow-up survey was conducted four months after the campaign’s launch, to garner feedback from a sample of users as well as non-adopters.

This note discusses learnings and insights from Catalyst’s pilot UPI awareness and activation campaign, followed by insights from the feedback survey that was conducted in March 2018. It provides an analytical perspective on the features that work in favour of BHIM, and barriers to its wider adoption and use. From a use perspective, insights suggest that the BHIM application faces stiff competition from other UPI applications and payment platforms in the market. The authors make a case for reorienting BHIM as an ‘ecosystem enabler’ and propose two strategies to this end.

BHIM – SETTING THE STAGE FOR A NEW INTERFACE

ENABLING SMALL MERCHANTS TO USE UPI

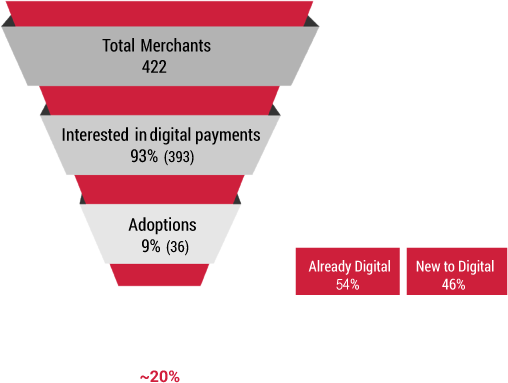

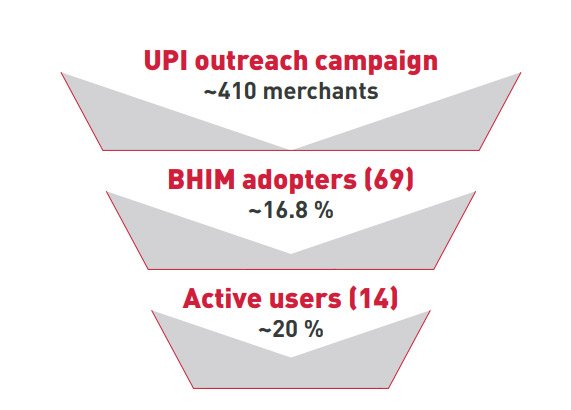

In October 2017, Catalyst implemented a pilot project to assess the suitability of UPI as a payment solution for small retail merchants and test the role of financial incentives in driving adoption and sustained use. The project tested the suitability of two UPI-enabled applications– NPCI’s BHIM UPI and Flipkart’s PhonePe.

Barkat Nagar in Jaipur was chosen for this survey because it is a major mixed-use market that is surrounded by a dense residential colony. It is frequented by a younger demographic that may be more amenable to digital payments adoption. Moreover, there is a fair penetration of prepaid digital wallets among merchants in the market which indicates a certain level of pre-existing digital payment awareness and familiarity.

The pilot campaign was conducted in partnership with NPCI and PhonePe and they provided the data for transactions on the respective platforms. It comprised of the following phases:

GENERATING AWARENESS AND IDENTIFYING LEADS

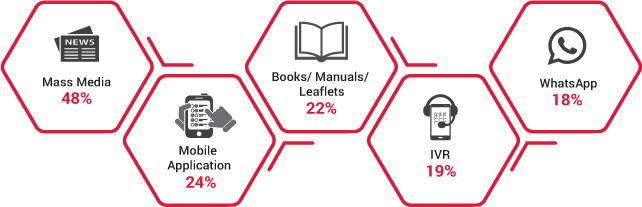

A 10-day awareness campaign to emphasize the benefits and ease of using QR-based digital payments was conducted in the market cluster using a combination of feet-on-street activities and kiosks that were set up in various locations inside the market, with support from the local market association. Learnings from a prior experiment conducted by Catalyst in the same market suggest that door-to-door marketing campaigns and kiosks across prominent locations in the market prove successful in garnering merchant interest. Moreover, proprietors of small retail businesses are typically strapped for time and manpower, and may find it challenging to step away from the store to participate in awareness campaigns. Drawing on this insight, multiple touch points were used to reach out to small merchants and consumers in the market and its vicinity, with the assumption that these activities would create awareness among a critical mass of people and spur two-sided network effects of payments.

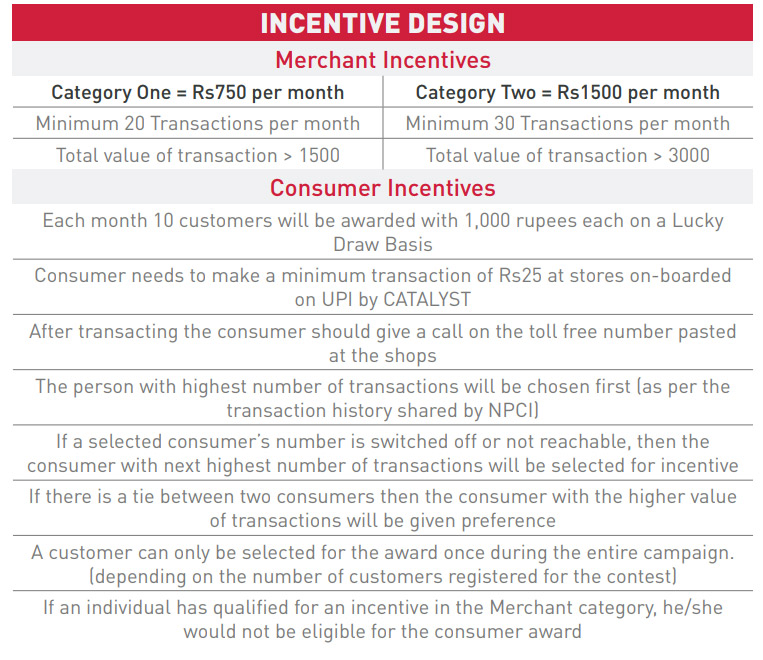

Nearly 40,000 flyers were circulated in Barkat Nagar through newspapers, an additional 15,000 flyers were distributed through kiosks in the market, and 5,000 flyers were distributed by merchants to their customers. To improve the effectiveness of the awareness campaign, the information was packaged and delivered through collaterals in the local language. It consisted of information on steps to use the QR code to make payments, details about the incentive schemes for merchants and consumers (Table 1) and list of shops that would accept payments through the UPI QR code.

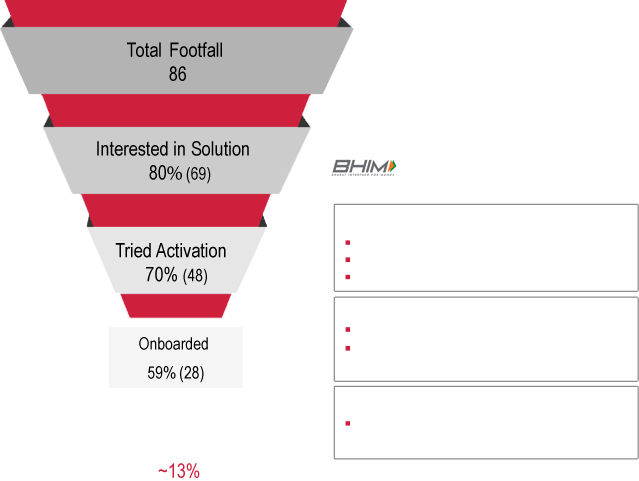

HANDHOLDING THROUGH ONBOARDING AND ASSISTED USE

Since the BHIM application and the UPI-based technologies were relatively new in the market at the time, handholding merchants through the onboarding process and assisting them to try the solution at no-cost/ risks formed a key part of the campaign. Merchants who expressed interest in adopting the solution during the outreach campaign were assisted with the onboarding process on BHIM, generation of QR and printouts of QR code stickers. They were also given detailed information regarding the incentive schemes for them as well as consumers and provided with collaterals illustrating steps to pay via QR code.

ONGOING MONITORING OF USE, NUDGES AND AWARD OF INCENTIVES

Since mid-October 2017, month on month data on transactions conducted via BHIM UPI has been tracked for the sample of adopters (69).

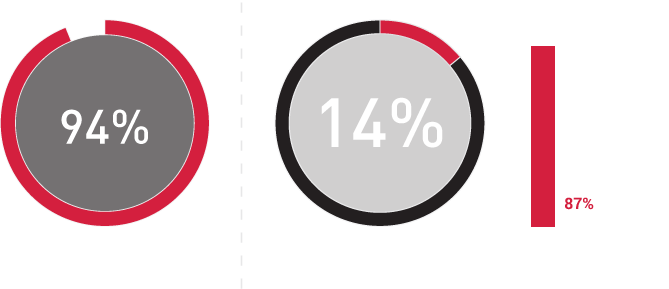

Data from NPCI suggests that while UPI transactions in India have seen a consistent rise in volume and value in 2017-18, BHIM’s share in UPI transactions has not seen a concomitant increase. Transaction data shared by NPCI for merchants in our sample for November 2017-February 2018 also suggests that while there was significant interest in adoption at the time of the outreach campaign, it did not translate into high adoption rates and sustained use on a month on month basis. On an average, only 14 out of the 69 merchants (about 20%) of BHIM adopters were using it actively. (A merchant was classified as an active user if he/she had conducted more than five digital transactions for at least two of the four months.)

FEEDBACK EXERCISE

Feedback from merchants in the first month of the campaign suggested that the minimum threshold of 30 transactions in a month, and 20 unique transactions to avail the financial incentives was relatively high. The initial design of the incentives was modified based on this input – the monthly threshold was reduced to 20 transactions and the criterion of unique transactions was relaxed. Based on usage data for November 2017, the first cohort of winners was awarded the financial incentives at a ceremony conducted in January 2018. To understand the potential factors responsible for the low adoption and usage rates, a follow-up survey was conducted through in-depth interviews with a sample of 25 merchants from those who were targeted as part of the outreach campaign for the intervention. The sample for the follow-up dipstick study included 20 merchants who had adopted BHIM QR and five merchants who did not adopt it, for various reasons. The adopters consisted of a combination of active and inactive users. A merchant was classified as an active user if he/she had conducted more than five digital transactions for at least two months during the study. The 20 adopters consisted of six active users, seven users who reported low to moderate transaction levels, and seven non-users (merchants who were on-boarded to the application but did not undertake any transactions).

KEY INSIGHTS

DRIVERS FOR ADOPTION AND USE

i.Seamless transfers between accounts

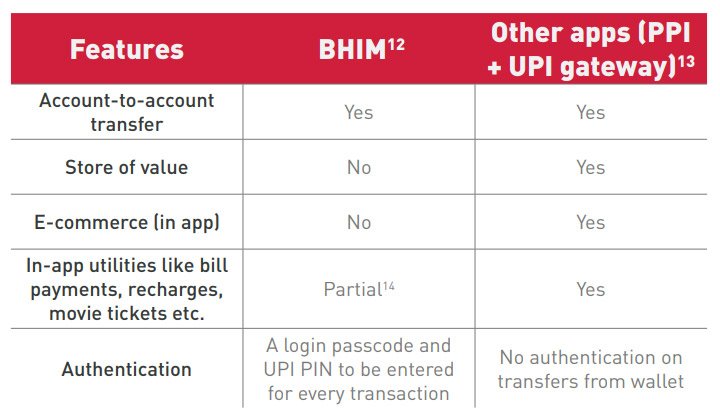

Merchants acknowledge the convenience of account-to-account transfer offered by BHIM as against the manual/ lagged credit of payments to their bank accounts in the case of prepaid wallets. This played an important role in encouraging trial and adoption of BHIM in the pilot. Nearly 50% of BHIM adopters interviewed in the feedback exercise found the account-to-account transfer facility as a defining feature of the application. It is important to note that merchant’s frame of reference for digital payments mainly consisted of prepaid wallets such as Paytm which did not have the UPI functionality at the time. Thus, in relation to e-wallets such as Paytm, BHIM UPI and PhonePe offered a more seamless payment experience.

ii.Trust

The perception of trust associated with an application endorsed by the Government of India, coupled with the nationwide marketing campaign at the time of launch were motivating factors for adoption as well.

This trust may be due to an implicit understanding of it being a “safer” means to pay. 10% of the adopters cited this as a reason for adoption/important feature of BHIM.iii.Handholding to on-board

Feedback from merchants suggests that the extensive handholding and assistance in carrying out actual transactions played an important role in encouraging them to try the technology. More than 30% of the adopters alluded to this in the survey. While such go-to-market models may be difficult to scale across markets, it is important to acknowledge the need to support assisted use of new technologies and solutions among users who are in the early stages of digital payments use and adoption.

BARRIERS TO ADOPTION AND SUSTAINED USE

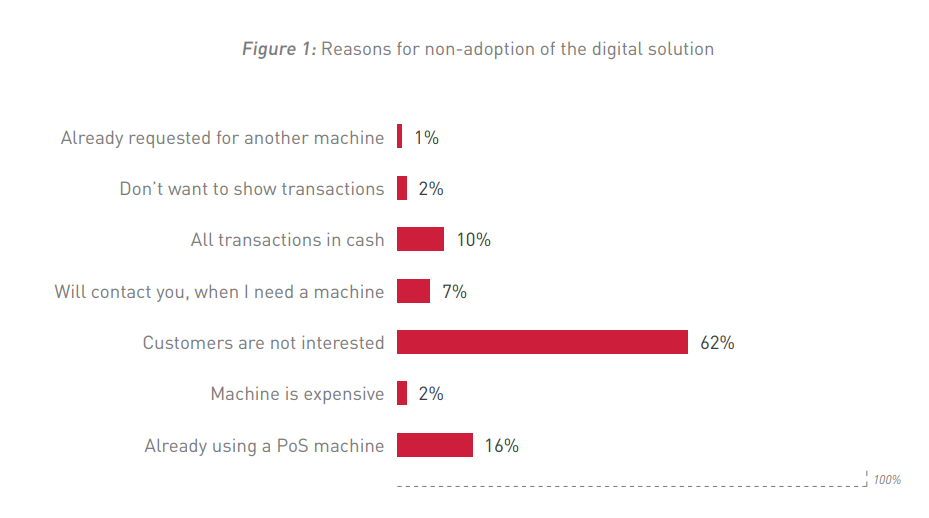

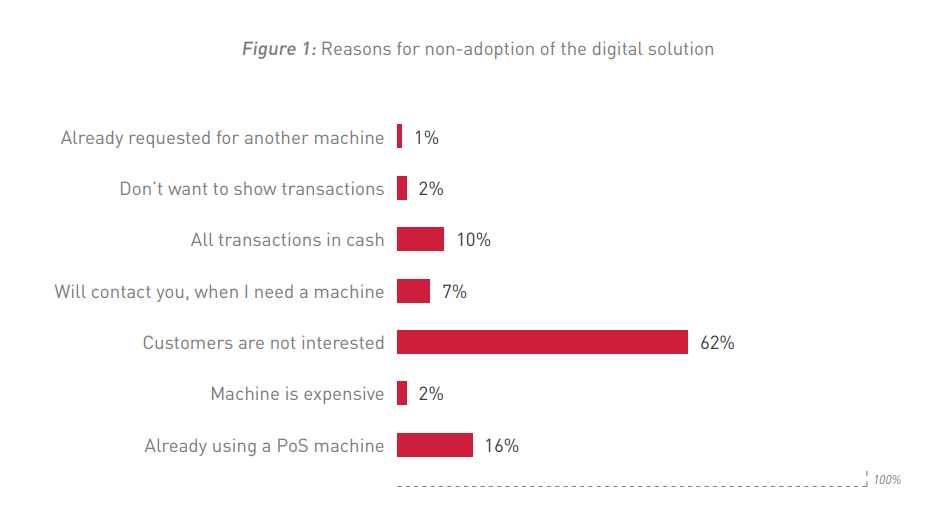

Low merchant acceptance of digital payments remains a barrier to widespread adoption of digital payments at the last-mile – nearly 40 million merchants still do not accept any form of digital payments. In our study as well, while merchants exhibited a fair level of awareness and familiarity with digital payment solutions, their share in overall transaction values is not significant. Our study suggests that merchant adoption is motivated by a combination of factors which include reducing on-boarding frictions, incentives such as cashbacks and rewards, and preferences of transacting counterparties such as customers and suppliers. The qualitative survey conducted as part of the project suggests that the following barriers may have played an important role in influencing merchant’s adoption and subsequent use of BHIM:

i.On-boarding frictions

There were some bottlenecks in signing up on the BHIM application, such as:

- After linking the bank accounts with the application, it asks the user to set a UPI PIN. For that the user is required to put in the last 6 digits of the debit card and the expiry date. Because of this, some merchants who did not have a debit card linked to their current accounts could not on-board on BHIM as they did not want to link their savings account to BHIM.

- Some merchants also encountered issues in the process of getting the OTP to register on the application.

ii.Stickiness of cash in merchant ecosystem

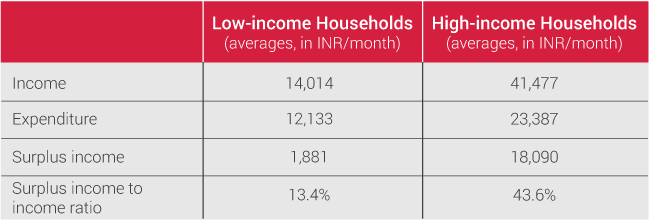

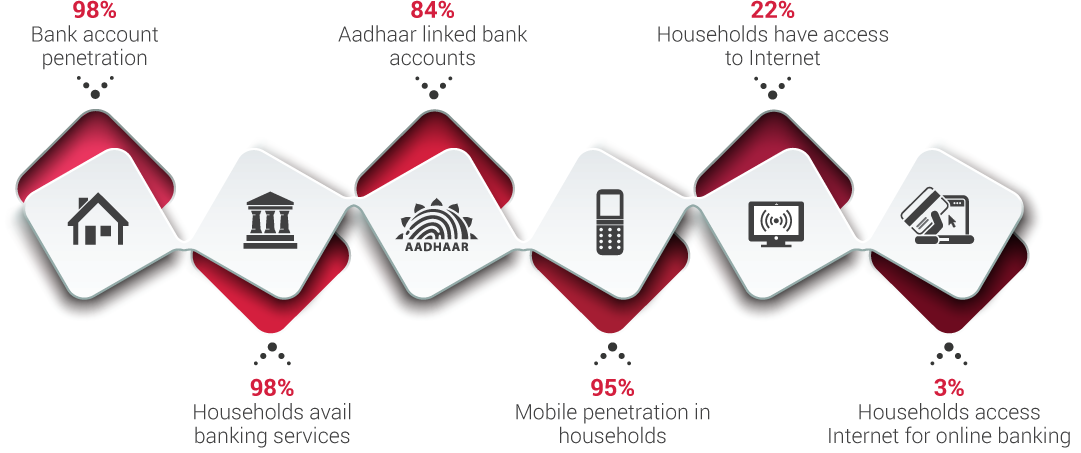

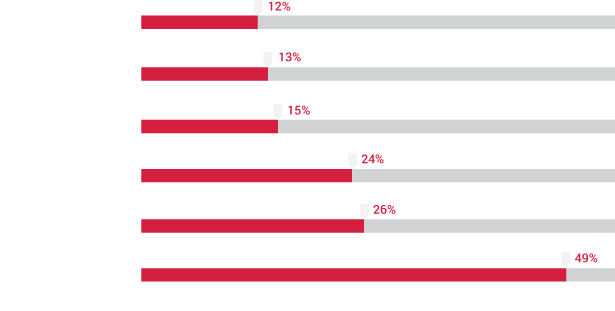

Although merchants were using apps like Paytm and BHIM for business purposes, the total value of such transactions did not account for a significant proportion of their business operations. Almost 30% of the 25 merchants interviewed revealed that majority of their transactions were in cash, primary reasons being that customers prefer cash and suppliers also had to be paid in cash. The stickiness of cash is also reflected in a study that Catalyst conducted in collaboration with PRICE. In the study, 55% of the non-adopters of digital payments cited lack of customer demand as one of the primary reasons for non-adoption.

iii.Weak Incentive Design

Financial incentives such as cashbacks/referral bonuses offered by other applications (like Paytm) in the market were seen as more lucrative by merchants and customers as compared to the incentives on BHIM, as at the time of the study, incentives on BHIM were significantly lower than other applications. The process for availing rewards/cashbacks from referrals is fairly simple in these applications as well. Moreover, they offer customers the flexibility to use the cashbacks and rewards in multiple ways such as utility bill payments, in-app purchase of goods and services or payments at locations like petrol pumps and movie theatres. Additionally, they offer rewards on mobile recharges, bill payments among other payment use-cases.

The drawback in the initial incentive scheme has been addressed to an extent with NPCI’s announcement of a revised scheme of incentives for on-boarding and use, in April 2018. This includes a cashback of INR 51 for customers successfully completing their first financial transaction, cashbacks of upto INR 750 for users registered as customers, and cashbacks of upto INR 1,000 for users registered as merchants linked with minimum transaction values and volumes.

iv. Low awareness and demand for BHIM in merchant ecosystem

Merchants also reported lack of awareness among customers and subsequent demand from them to pay via BHIM as an important reason for the low use of BHIM. While the revised incentive schemes for BHIM referrals and cash back mentioned above could give a fillip to transactions, low awareness and adoption among customers remain a barrier to sustained use by merchants.

The low demand for BHIM in relation to payment solutions such as e-wallets and other UPI applications may be a function of the first mover advantage that incumbent service providers enjoy in the market. Being early in the market has allowed private payment service providers to establish a wide network of merchants and customers and facilitate easy recall value, which are important determinants of success in a two-sided market like payments. Moreover, entities such as Paytm have invested heavily in online and offline marketing campaigns, which has strengthened brand recall among customers as well as merchants.

v. Limited Use Cases

The limited range of use cases of the BHIM application at the time of its launch, as compared to other digital payment offerings in the market is also an influencing factor. Given the competition in the payments ecosystem, providing differentiated features is important for payment service providers to incentivise users to choose one solution over another.

Our study also reveals that users value such product differentiation significantly. Illustratively, PhonePe and Paytm both have a PPI license and on the one hand allow account-to-account transfer through UPI and on the other, allow the customer to use the PPI balance for making in-app purchases of goods and services from the merchants on-boarded on the platform. Additionally, they provide options to make bill payments and mobile recharges, among other facilities. Until recently, BHIM was primarily a conduit for account-to-account transfer and has been upgraded to include a bill payments feature as well.

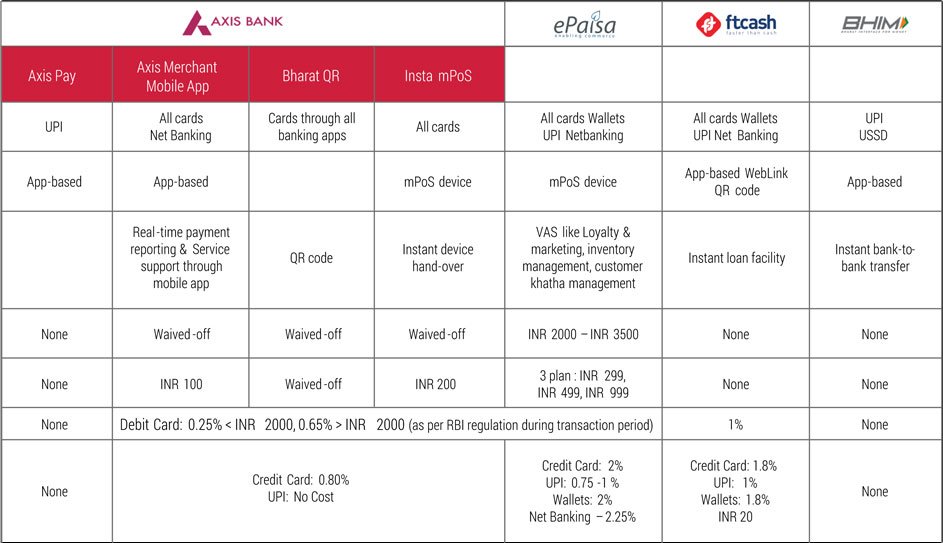

RE-IMAGINING BHIM

In a move to spur greater adoption of UPI and facilitate recall value among users, all bank-led UPI applications in the market have been rebranded with the prefix ‘BHIM UPI’.15 This implies a change in nomenclature at the front-end of these applications (e.g. BHIM SBI Pay/BHIM Axis Pay), while they continue to operate on the UPI interface. Thus, on one hand, the BHIM application is a platform that enables merchants and customers to make UPI-based payments, and on the other hand, it has been positioned as a larger entity which is synonymous with the UPI interface.

In light of these developments in the larger BHIM/UPI ecosystem, and the demand-side constraints in scaling the BHIM application articulated above16, there is a strong case for reimagining BHIM as an ecosystem enabler – beyond its role as a payments application.

This proposition is based on a combination of factors which suggest that BHIM is uniquely placed to play such a role in the ecosystem. These include the large volumes of transactional data available on the platform which can be opened up to further innovation through secure APIs, promoter NPCI’s organic linkages with banks and complementarities of value added services with payments. We make a case for two ways in which the BHIM ecosystem can be creatively reimagined below.

BHIM AS AN AGGREGATOR OF FINANCIAL SERVICES

Presently, 92 banks are live on BHIM and it has recorded 58.16 million transactions in 2018. Further, the BHIM mobile application has been downloaded on 28.9 million devices, meaning that it contains data about consumer and merchant transactions. This data can be accessed by developers (in compliance with best practices to safeguard users’ data privacy), financial services providers and other Fintech companies for building “Over the Top” applications and complimentary products that may be offered within the BHIM app interface. Enabling secure access to data aggregated on BHIM can facilitate innovation by financial institutions, Fintech companies and other stakeholders who can utilise this information to develop customised financial service products.

This kind of integration, with BHIM acting as an aggregator for merchant-centric products, can play a role in bridging the credit gaps for the MSME segment. Another potential use-case is for the BHIM app to offer an insurance products marketplace and facilitate access to insurance products to merchants that operate these small businesses.

Under the extant regulatory framework, offering insurance aggregator services requires an entity to be licensed by the IRDA. Symmetrically, offering financial products like Mutual Funds requires the entity to retain a distributor license from SEBI. Since NPCI, the promoter and operator of BHIM, is a Section 8 Company incorporated with the objective to set up and implement retail payment systems in the country, the aforementioned proposal will require regulatory concessions from the relevant regulators

Given the socially beneficial impact of reorienting BHIM as an online marketplace for complimentary financial products, there is a compelling case for the NPCI to partner with the Ministry of Electronics and Information Technology and the Ministry of Finance to work with the concerned regulators to obtain these regulatory concessions. NPCI’s role as the umbrella retail payments organization in India and the fact that it is already a regulated entity under the Reserve Bank of India’s jurisdiction bolsters the case.

The potential illustrative workflow of such an offering is:

- In addition to the ‘Send’, ‘Request’ and ‘Scan and Pay’ option, the application Home Page offers a section titled ‘Other Services’

- Contained within ‘Other Services’ is a “catalog” that offers a host of financial products and services including credit, insurance (even potentially mutual funds).

- Here the merchant can view, and compare, the products offered by banks, insurance companies and AMCs

- The merchant can then click through to initiate the purchase of the product/service.

Policy related to small business credit could be amended to create high powered incentives for banks to originate credit from leads generated on the BHIM application. Though these high powered incentives could be delivered through several channels, we suggest a ranking system monitored by a government think-tank like Niti Aayog linked to the volume of credit that banks originate through the leads generated on BHIM.

MERCHANT SOLUTIONS ON BHIM

In addition to efforts to popularise BHIM among merchants using cashback schemes, providing value-added services such as a ‘khaata’ feature can enhance its utility to merchants. A ‘khaata’, colloquially, is a ledger kept by businesses to record sale and purchase transactions. With BHIM increasing the convenience in collecting payments for merchants, additional value can be unlocked by incorporating a dashboard for a ‘digital khaata’ in the platform. A “digital khaata” would record the business transactions paid through BHIM as “sales” and “purchase”. This would entail easy reconciliation and more efficient management of business operations. For instance, it may allow merchants to track supplier payments and send payment requests, and get paid seamlessly through the app. This khaata may also be used to undertake customer analytics for the merchants to generate insights on what could drive business for them. Illustratively, insights on sales trends can help the merchant design better sales strategies and map loyal customers. Conversely, purchase trends may yield data which aids the merchants in better inventory management.

BHIM can also be repurposed as a platform for business to business interaction. Illustratively, a merchant may design and market customised, time bound offerings for its clients via BHIM. Doing this would significantly expedite business communication and allow merchants to instantly accept and pay for such offers.

A potential target group for the testing of such a solution can be found in India’s vast network of small retail businesses. These businesses enjoy a regular local clientele from neighbouring residential and commercial areas and maintain physical registers. The analytics component of this digital khaata solution can help these small businesses design customer loyalty programs, and keep track of bills and payments due to distributors.

It is of importance to acknowledge that this solution may only be applicable to businesses which may not find it feasible to invest in ERP solutions to manage their business operations.

TOWARDS AN ECOSYSTEM APPROACH

Insights from Catalyst’s small merchant UPI activation project and feedback from ongoing monitoring and evaluation suggest that providing seamless account-to-account transfers alone may not be enough to incentivise widespread adoption and use of the BHIM app. While the revised scheme of incentives for BHIM use now places it at par with the incentives offered by other players in the space, and selected features such as utility bill payments have been added to the application, it continues to face stiff competition from UPI-enabled applications that offer multiple use cases, enjoy first-mover advantage and a strong brand recall. Strategies to promote further adoption and use of the BHIM application need to weigh potential gains in relation to these factors. The focus must instead shift on leveraging the application to test scalable use cases that can spur widespread adoption by merchant and consumers, and create an enabling ecosystem for service providers to innovate.

TECHNICAL WRITERS: Mandar Kagade, Janak Priyani, Diksha Singh and Raghav Katyal.

ACKNOWLEDGEMENTS:The authors would like to thank Kanika Joshi, Darshan Singh and Anil Kumar Pandey for their support in data collection and analysis.